Find the Best Unsecured Business Loans

Grow your business and manage your cash flow

We provide unsecured cash advances that keep your business moving

The CLICKCAPITAL process follows a unique PAY-AS-YOU-TRADE system, ideal for business owners who have a monthly average of over $10 000 in card sales and have been operating for 6-12 months.

We agree to a fixed repayment percentage and we deduct the repayment from your takings. This can be done using our lenders own eftpos terminals or through your own

Unsecured

Asset security not required. No need to put your house on the line: all you need are director’s guarantees.

Flexible

Cash Advances from $5k – $500k, terms from 3-24 months, for any business purpose.

Fast

Decisions in as little as 1 hour – 90% of customers receive their funds within one business day.

Helpful

Our friendly team is availalbe 9am – 9pm 7 days a week. For support please call 1300 617 673 or chat online.

Fast, Hassle-Free Loan Matching in 3 Easy Steps.

Just 3 Simple Steps to Instant Finance — No Impact on Your Credit Score!

1. Tell Us About Your Business

Answer a few quick questions – it takes less than 2 minutes.

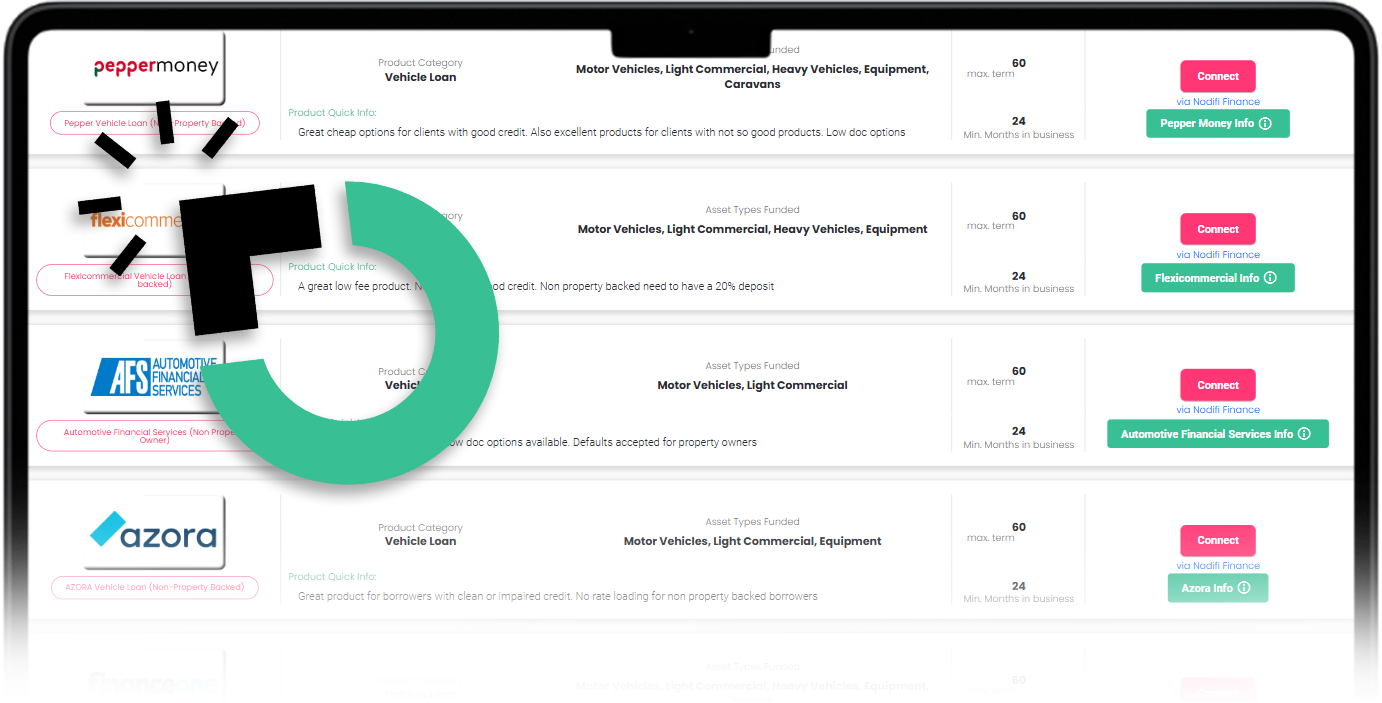

2. Compare Your Options

3. Get Funded Fast

How do I qualify for an unsecured Cash Advance?

At Clickcapital we like to make it easy for you to access the funds you need to grow your business. You can either fill out our, or call one of our friendly team on 1300 617 673, so they can help you with the application. The form takes approximately ten minutes to complete.

For loans of $100,000 or less, all you need to have ready is:

1.Your Driver’s Licence number

2. The ABN for your business

3. The BSB and account number of your main trading account.

For small business cash advances over $100,000 you will also need some basic financial statements like a P&L and cashflow, so we can evaluate the health of your business and see what kind of repayments your business can manage. Once you’ve submitted your application, one of our friendly team will call to check we have all the information we need and customise a solution for you. It really is business finance made easy.

Find out more in our FAQ section at the bottom of this page.

Love at first loan? Our customers think so!

“The team at Clickcapital were amazing. I needed funds to fit out a new surgery. I applied online and within 2 days I had the money in my account”

“I have just taken on two new apprentices and we needed a capital injection to keep us going in between getting paid for jobs. Clickcapital’s Unsecured Business Loan was perfect for us. It kept us going in between being paid”

Got questions? We’ve got answers!

Unsecured Cash Advances are a great tool for growing your business. The banks don’t like doing them because they don’t require your house as security. Here are the questions we often get asked.